RBI Guv asks banks to remain vigilant against build-up of risks

RBI Governor Shaktikanta Das compliments Indian banks for business model viability, outlier growth in personal loans and adherence to co-lending guidelines. He asked Banks to focus on IT and cyber security preparedness, operational resilience, digital frauds, and strengthening of the internal rating framework

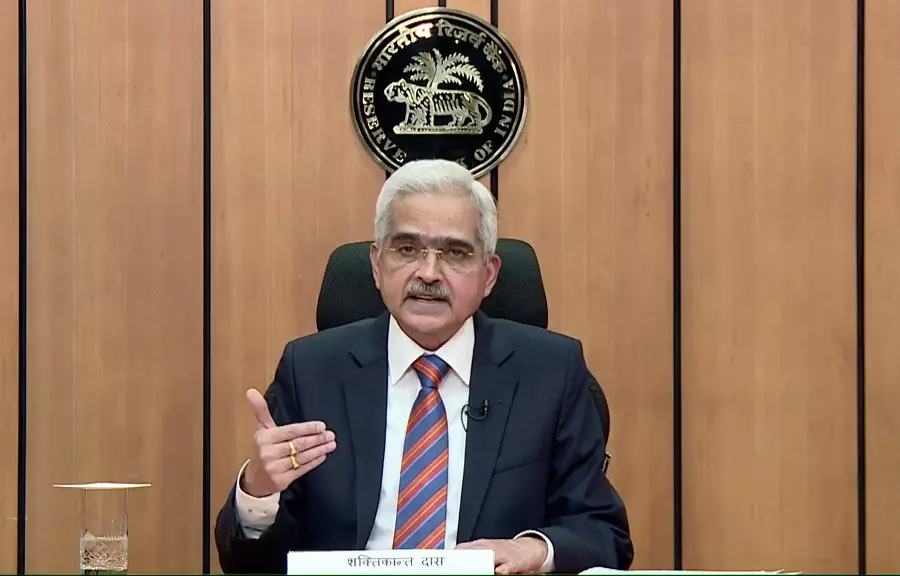

image for illustrative purpose

Mumbai: RBI Governor Shaktikanta Das on Wednesday asked banks to remain vigilant against build-up of risks in the banking system as there is no scope for any complacency. The Governor held meetings with MD and CEOs of public-sector banks (PSBs) and select private-sector banks as part of RBI’s continuous interaction with the senior management of its regulated/supervised entities. The Governor in his remarks complimented the banks on their improved financial performance and that of the whole banking sector, the Reserve Bank of India (RBI) said in a statement.

“While noting the resilience of the domestic financial system with healthy balance sheets of banks, he observed that there is no scope for any complacency and banks should continue to maintain their vigil around build-up of risks, if any,” it said.

Das highlighted the issues relating to business model viability; outlier growth in personal loans; adherence to co-lending guidelines; bank exposure to the NBFC sector; and liquidity risk management. He also spoke on matters concerning IT and cyber security preparedness, operational resilience, digital frauds; and strengthening of the internal rating framework. The Governor stressed that customer grievance redressal mechanism and protection of customers’ interests are of paramount importance for the safety and stability of the financial system and that of individual financial institutions. Banks were also encouraged to actively participate in RBI’s fintech initiatives and give a further push to Digital Banking Units (DBUs). The meetings were also attended by deputy governors M Rajeshwar Rao and Swaminathan J, along with executive directors-in-charge of regulation and supervision functions.